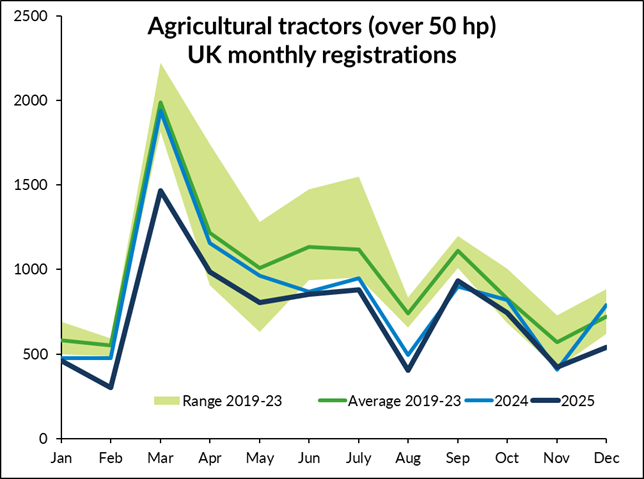

The number of agricultural tractors (over 50hp) being registered in the UK and Northern Ireland market remained low in December 2025, with just 541 machines recorded during the month, the lowest number for the time of year since 2016, according to the latest Agricultural Engineers Association (AEA) report. That total was more than 30% lower than in the same month of 2024 and was also down by a quarter, compared with the average December figure over the previous five years.

The UK and Northern Ireland tractor market remains at a low ebb, according to the AEA, due to a lack of confidence in the farming sector, prompted by factors including uncertainty about future agricultural and tax policy, challenging weather conditions, increased costs and weak prices for some commodities, notably arable crops.

December’s figures brought the total number of agricultural tractors registered last year to a modest 8,791 machines. That is 14% fewer than during 2024 and is the lowest figure since AEA began monitoring tractor registrations in the 1960s. In reality, the number of tractors sold during 2025 was almost certainly at its lowest level since before World War II.

This doesn’t quite tell the whole story, as modern tractors are much larger (and hence can cover more ground) than those in earlier years. Nevertheless, while there have been similarly challenging periods in the past, for example in the late 1990s/early 2000s, last year was certainly one of the most difficult the industry has experienced.

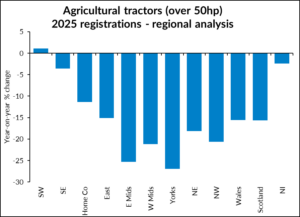

The AEA report shows how trends vary between different power bands and parts of the country. Almost all power bands saw a decline in registrations between 2024 and 2025, but the biggest falls were at the top end of the power range.

The number of tractors over 240hp registered last year was down by nearly a third, compared with the year before, reflecting the challenging financial position of arable farmers, who are the main buyers of these larger machines. Below that level, the decline was a more modest 11%. Nevertheless, the 11% share of the total accounted for by machines over 240hp was still higher than in any year before 2024.

The number of tractors registered in 2025 was lower than the year before across most of the country, although the Southwest of England was an exception. Here, slightly more machines were logged that in 2024, but numbers were down everywhere else. That perhaps reflects the better fortunes of the dairy sector, which makes up a sizeable proportion of agriculture in that region. The Southeast of England and Northern Ireland also saw relatively small declines but the rest of the country recorded year-on-year falls of at least 10%. Yorkshire, the East Midlands and North Wales were the worst affected regions, with less than three-quarters as many registrations as in 2024.

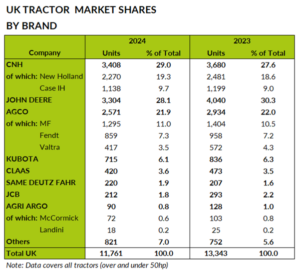

Market shares for tractors registered in 2024 can be found in the table below, with figures for the previous year provided for comparison. These figures cover all power bands, including machines under 50hp. Competition law restrictions mean that AEA is not able to publish market share figures for tractors until 12 months have elapsed.

The combined CNH brands of Case IH and New Holland increased market shares in 2024 compared with 2023, while John Deere dropped marginally, while still retaining overall brand leadership in the market which dropped sales of 1,582 units compared with 2023.

While overall AGCO brands improved their market share, Massey Ferguson and Fendt improved while Valtra’s share declined marginally. Claas and Same Deutz-Fahr showed marginal market share improvements against that background of lower unit sales.